Mexico is an increasingly attractive destination for foreigners, offering opportunities for both work and leisure. If you’re a foreigner with a temporary or permanent resident card, you might be wondering how you can legally work in the country. Whether you’re looking to work remotely, for a Mexican employer, or start your own business, Mexico offers various pathways that allow foreigners to participate in its economy.

In this article, we’ll explore the different ways foreigners can work in Mexico, the necessary legal processes for each and key resources to help navigate the system.

Understanding Work Eligibility

Mexico offers 2 main types of residency for foreigners: temporary and permanent residency. Though there are others (e.g., temporary student), temporary and permanent residency are the most common. Both allow foreigners to reside in Mexico legally, but they come with different rights and responsibilities when it comes to employment.

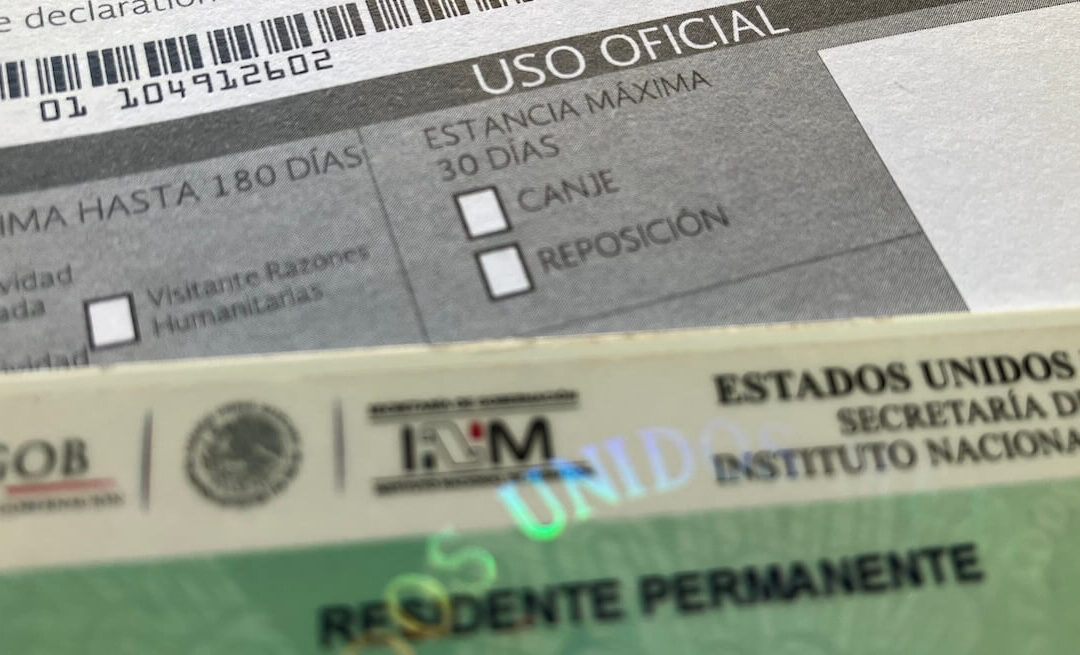

A temporary resident card is issued to foreigners who plan to live in Mexico for more than 6 months but less than 4 years. As a temporary resident, you can work in Mexico, but you’ll need to apply for work authorization with the Instituto Nacional de Migración (INM), which is the immigration authority in Mexico.

A permanent resident card allows foreigners to live in Mexico indefinitely and offers more freedom when it comes to work. As a permanent resident, you are automatically eligible to work in Mexico without needing an additional work permit. However, you will still need to notify (not apply) INM of your place/type of employment.

Ways to Legally Work

Depending on whether you have temporary or permanent residency, there are multiple paths for you to work legally here in Mexico. Additionally, you will need to register with Mexico’s tax authority, which is Servicio de Administración Tributaria (SAT) to obtain a Registro Federal de Contribuyentes (RFC) number, which is your unique tax payer ID, which allows you to pay taxes. You need to obtain an RFC number first before initiating anything with INM.

1. No residency – Job offer from Mexican employer

If you don’t yet have temporary or permanent residency, but you’ve been offered a job in Mexico, you’ll need to have the employer initiate the work authorization process with INM.

Here’s how the process typically works:

-

- Receive job offer: First, you must secure a job offer from a Mexican employer.

- Employer application with INM: The employer is then responsible for initiating the work authorization process with INM.

- Work authorization issuance: Within 30 days of your work authorization being approved by INM, you’ll need to visit a Mexican consulate outside of Mexico for a consular interview. Provided the interview goes well, the consulate will issue you a visa sticker in your passport, which is for one-time use and allows you to legally enter Mexico in order to finalize your temporary work residency. After entering Mexico, you’ll have 30 days to initiate (not complete) the finalization of your temporary work residency at INM and receiving your physical resident card.

- Residency card: Once you receive your temporary work resident card, it will come with work authorization linked to your employer. Be sure to keep all confirmation documentation you receive from INM as proof of your compliance.

Required documents (and copies), at a minimum:

-

-

- Valid passport.

- Proof of RFC – constancia de situación fiscal.

- Official identification of employer.

- Employer’s registration certificate.

- Official job offer and contract from the Mexican employer.

- No other pending applications for job offers from other employers.

- Payment of fees.

-

2. Temporary residency – Job offer from Mexican employer

If you already have temporary residency and plan to work for a Mexican company, you (versus the employer) will need to initiate the work authorization process with INM.

Here’s how the process typically works:

-

- Receive job offer: First, you must secure a job offer from a Mexican employer.

- Application with INM: You are responsible for initiating the work authorization process with INM, not the employer.

- Work authorization issuance: If INM approves your application, you will be provided the appropriate documentation as proof of your work authorization.

- Residency card: Once you receive your work authorization, you will also be issued a new residency card to reflect your permission to work. Be sure to keep all confirmation documentation you receive from INM as proof of your compliance.

Required documents (and copies), at a minimum:

-

-

- Valid passport.

- Valid temporary resident card.

- Proof of RFC – constancia de situación fiscal.

- Employer’s registration certificate.

- Official job offer and contract from the Mexican employer.

- Payment of fees.

-

3. Permanent residency – Job offer from Mexican employer

If you’re a permanent resident, you are automatically eligible to work. You simply need to notify INM about your new employment, but you don’t need to apply for additional work authorization.

Here’s how the process typically works:

-

- Notification with INM: You are responsible for initiating the work notification process with INM.

- Notification acceptance: After INM processes your work notification, you will be provided the appropriate documentation as proof of your notification.

- Residency card: Once your notification request is processed, you will not be issued a new residency card. Be sure to keep all confirmation documentation you receive from INM as proof of your compliance.

Required documents (and copies), at a minimum:

-

-

- Valid passport.

- Valid permanent resident card.

- Proof of RFC – constancia de situación fiscal.

- Notification letter (generated online).

- There are no fees.

-

4. Temporary and permanent residency – Working remotely as an independent contractor/self-employed

In today’s digital age, many foreigners choose to work remotely while living or traveling in Mexico. If you have a job or business based outside of Mexico and work online, you do not need to obtain work authorization since you’re income is earned outside of Mexico. However, if you’re planning to freelance for Mexican clients or companies, you will need to apply for work authorization as described below.

5. Temporary and permanent residency – Working in Mexico as an independent contractor/self-employed

Temporary residents: Freelancing for Mexican clients requires you to apply for work authorization with INM.

Here’s how the process typically works:

-

- Application with INM: You are responsible for initiating the work authorization process with INM.

- Work authorization issuance: If INM approves your application, you will be provided the appropriate documentation as proof of your work authorization.

- Residency card: Once you receive your work authorization, you will also be issued a new residency card to reflect your permission to work. Be sure to keep all confirmation documentation you receive from INM as proof of your compliance.

Required documents (and copies), at a minimum:

-

-

- Valid passport.

- Valid temporary resident card.

- Proof of RFC – constancia de situación fiscal.

- Letter describing your intended work activities (generated online).

- Other relevant documents (e.g., portfolio, client agreements, etc.).

- Payment of fees.

-

Permanent residents: You can legally freelance without needing additional work authorization. Like mentioned earlier, you still need to notify INM of your place/type of employment.

Here’s how the process typically works:

-

- Notification with INM: You are responsible for initiating the work notification process with INM.

- Notification acceptance: After INM processes your work notification, you will be provided the appropriate documentation as proof of your notification.

- Residency card: Once your notification request is processed, you will not be issued a new residency card. Be sure to keep all confirmation documentation you receive from INM as proof of your compliance.

Required documents (and copies), at a minimum:

-

-

- Valid permanent resident card.

- Notification letter (generated online).

- Proof of RFC – constancia de situación fiscal.

- There are no fees.

-

5. Starting a business in Mexico

If you’re an entrepreneur, Mexico offers several opportunities for foreigners to start their own businesses. Whether you want to open a local shop, invest in real estate, or start a tech company, both temporary and permanent residents are eligible to open businesses in Mexico.

Here’s how the process typically works:

-

- Register the business: You’ll need to register your business with the Registro Público de Comercio (Public Registry of Commerce), where you’ll choose the legal structure of your business (e.g., sole proprietorship, partnership, corporation, etc.).

- Obtain a business tax ID: As a business owner, you’ll also need to register with SAT and obtain an RFC number. This will allow you to pay taxes and issue official invoices (facturas). SAT issues RFCs for both businesses (persona moral) and individuals (persona física).

- Notify INM: Temporary residents who wish to start a business will need to apply for work authorization with INM, as mentioned previously. Permanent residents don’t need additional work approval but will still need to inform INM, as stated earlier.

- Residency card: If you are a temporary resident, you will also be issued a new residency card to reflect your permission to work. If you are a permanent resident, you will not be issued a new residency card. In either case, be sure to keep all confirmation documentation you receive from INM as proof of your compliance.

Required documents (and copies), at a minimum:

-

-

- Valid passport.

- Temporary or permanent resident card.

- Business plan and legal registration of your business.

- Proof of RFC – constancia de situación fiscal.

- Other legal documents, depending on your business type.

-

Navigating Mexican Taxes and Social Security

If you work in Mexico as a resident, you are obligated to pay Mexican taxes. Here’s what you need to know:

-

-

- Tax registration: All workers, whether employees or freelancers, must register with SAT and obtain an RFC number for tax purposes.

- Social security: If you’re working for a Mexican employer, contributions to Mexico’s social security system (Instituto Mexicano del Seguro Social – IMSS) will be automatically deducted from your paycheck. Freelancers are not required to contribute but can opt into IMSS voluntarily.

- Tax rates: Mexico’s income tax rates range from 2% to 35%, depending on your income level. As a foreigner, you may also need to file taxes in your home country, depending on your home country’s tax treaties with Mexico.

-

Helpful Online Resources

Stay up-to-date on all relevant information in regards to INM and SAT as it relates to work authorization and tax obligations, as outlined in this article, by checking the following websites:

-

-

- Gob.mx: Mexico’s official federal government portal with details on all government matters, including providing detailed information on immigration, work permits and other legal procedures.

- INM: Mexico’s official federal government agency responsible for all matters related to immigration.

- INM micro website: Official website of INM where you can complete all immigration procedures/processes (trámites), schedule an appointment and more.

- SAT: Mexico’s official federal government agency responsible for the collection of taxes from individuals and businesses.

- IMSS: Mexico’s official federal government agency responsible for providing healthcare services, pensions and other benefits to workers.

-

Conclusion

Foreigners with temporary or permanent residency have multiple options for working in Mexico, whether through employment, freelancing or starting their own business. While the process can vary depending on the type of work you’re interested in, knowing the steps and requirements will help you avoid any legal complications.

By using resources such as gob.mx, you can stay up-to-date on the latest regulations and ensure that you are fully compliant while working in Mexico. As always, make sure to keep your residency status current and follow all local laws related to employment and taxation.

Please feel free to leave us a comment below about your experience of working in Mexico, whether for an employer or for yourself. We would love to hear from you! Additionally, if you found this article helpful, consider sharing it with others who might benefit from it. A quick share goes a long way in helping others discover useful information!

0 Comments