For anyone moving to or living in Mexico, navigating the local bureaucracy is a crucial part of settling in. One essential number you’ll come across is the Registro Federal de Contribuyentes (RFC). This tax identification number is used by Mexico’s tax authority – Servicio de Administración Tributaria (SAT) to track individuals and businesses for tax purposes. Whether you’re planning to open a bank account, start a business, or get a Mexican credit card, understanding the RFC process is essential. This article explains what an RFC is, why it’s required, the process of obtaining one, and situations where it might be necessary.

What is an RFC?

The RFC is a unique alphanumeric identifier issued by SAT. It serves a similar function to the Social Security Number (SSN) in the U.S. or Social Insurance Number (SIN) in Canada. The RFC is used to identify individuals (personas fisicas) and businesses (personas morales) for tax purposes, and it’s required for various official and financial transactions.

The format of the RFC consists of 13 characters for individuals and 12 characters for businesses. For individuals, it includes letters from the person’s first and last names, followed by a combination of numbers and letters that represent their date of birth and a homoclave, a verification code generated by SAT.

Why Is an RFC Required?

The RFC is essential for both residents and non-residents (to a lesser degree), especially if you plan on engaging in activities that involve the financial or legal system. Here’s why the RFC is required:

-

- Tax identification: The primary purpose of the RFC is to ensure that individuals and businesses comply with Mexican tax laws. Any economic activity you engage in, whether as an employee, entrepreneur, or investor is tracked using your RFC.

- Compliance with government regulations: Mexican authorities use the RFC to track income, ensure that taxes are paid, and monitor economic activities within the country.

- Financial transactions: Many financial institutions require an RFC to open accounts, apply for loans, or obtain a credit card. It helps track your financial history and confirm your tax compliance status.

Instances Where an RFC is Likely Required

The RFC is not only essential for tax-related matters, but is also required for various personal and professional activities. Here are some instances where you’ll likely need an RFC:

-

- Opening a bank account: Most banks, such as BBVA, Banorte, Citibanamex, and Santander, require an RFC when opening a personal or business bank account. The RFC verifies your identity, and ensures that you’re compliant with tax regulations.

- Obtaining a credit card: If you plan to apply for a Mexican credit card, your RFC will be necessary for the application process. Banks use it to evaluate your creditworthiness and to comply with government regulations.

- Signing employment contracts: When you work, your employer will ask for your RFC to report your income to the tax authorities. It’s a requirement for both full-time and part-time employees.

- Registering a business: Entrepreneurs need an RFC to register their business with SAT. The RFC enables the tax authority to track your business activities and ensure proper tax payments.

- Buying property: If you are purchasing property, especially as a foreigner, having an RFC will simplify the process of signing contracts, applying for a mortgage, and registering the property.

- Tax filings: If you plan to file taxes, whether as a resident or non-resident, your RFC is essential. The tax authority uses your RFC to track your income and any applicable tax deductions.

- Receiving invoices (facturas): When making significant purchases, such as vehicles, electronics, or home appliances, businesses often issue an official factura, which includes the buyer’s RFC. Facturas are essential for claiming tax deductions.

- Utility services: In lots of cases, you may be required to provide your RFC when applying for electricity, water, or internet services.

The Process of Obtaining an RFC

Getting an RFC is a relatively straightforward process so as long as all your paperwork is in order. Here’s a step-by-step guide on how to obtain one.

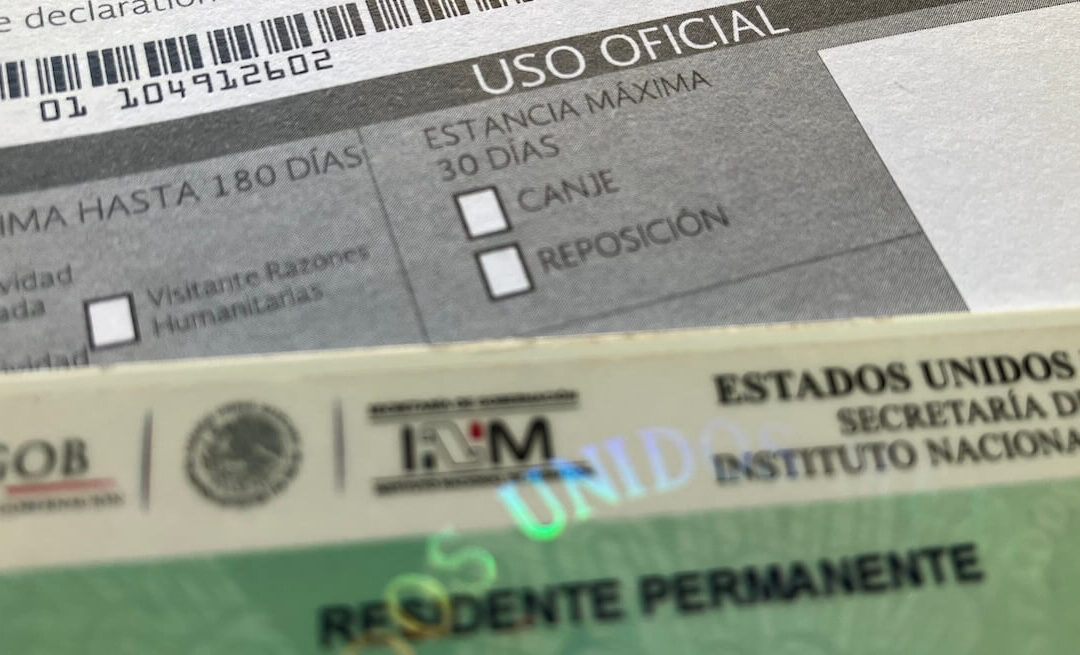

Step 1 – Determine Eligibility: Individuals (at least 18 years of age) and businesses can apply for an RFC. You can get an RFC whether you’re a Mexican citizen, a permanent or temporary resident, or a foreigner conducting business in Mexico. Tourists generally do not need an RFC unless they are engaging in economic activities, such as purchasing property or registering a business.

Step 2 – Gather Requirements and Copies: To apply for an RFC, at a minimum, you will need the following documents/items, information and copies:

-

- Valid passport.

- Residency card – temporary or permanent.

- Proof of address, e.g., CFE bill, Telmex bill, rental agreement, etc.

- Clave Única de Registro de Población (CURP), which is your population registry code. You can obtain your CURP document online, which you can download and print.

- Physical description of your residence, e.g., casa blanaca con 2 pisos.

- Email address and phone number.

- Proof of appointment, which can be scheduled online.

- Thumb drive, if applicable, for your e.firma (not required but recommended), which serves as your digital signature and allows you to make updates, among other functions, online.

If you’re applying for a business, additional documentation, such as your company’s legal constitution documents may be required.

Step 3 – Schedule Appointment: Previously, the only way to obtain an RFC was in-person at a SAT office. However, SAT now offers a Virtual Office (Oficina Virtual) where eligible individuals can obtain their RFC online. To determine if you qualify, visit SAT’s official website and check the requirements for online registration. For both the Virtual Office and in-person at a SAT office, you will need to schedule an appointment through SAT’s appointment portal.

Step 4 – Visit SAT Office (If Required): You can visit your local SAT office to complete the process. If applying through the Virtual Office, follow the online instructions to submit your documents in advance of your virtual appointment. Again, be sure to book your appointment in advance. You must:

-

- Present your documentation: You will need to present all of the required documents listed above.

- Provide biometrics, if applying for e.firma: During your appointment, you will be asked to have your fingerprints and retinal scan taken. You will not be able to obtain an e.firma through the Virtual Office since this involves SAT obtaining your biometrics.

Step 5 – Payment: There is no charge to obtain your RFC, unless you hire a facilitator to assist you.

Step 6 – Processing Time: After submitting all of your documention, your RFC is typically processed and issued at the conclusion of your appointment. Processing times may vary for the Virtual Office.

Step 7 – Receive RFC: In the overwhelming majority of cases, you will receive your RFC documented on your Constancia de Situación Fiscal (proof of tax status document) the same day, if all of your documentation is in order. The time spent at the SAT office and number of steps involved will depend on whether you are also applying for your e.firma, which involves obtaining your biometrics. Tbe time spent online during your virtual appointment through the Virtual Office may vary.

e.firma

Purpose of the e.firma in relation to the RFC:

-

- Digital identity: The e.firma serves as a digital signature and acts as your legal digital identity. It verifies your identity when conducting various transactions online with SAT and other government agencies. The e.firma is essential for securely accessing SAT services and for signing official documents electronically.

- Complements the RFC: While the RFC is your unique taxpayer identification number, the e.firma is an additional layer that allows you to electronically sign documents related to your tax obligations, such as filing taxes, submitting declarations, or performing other digital transactions.

- Legally binding: Any document signed with your e.firma has the same legal standing as one signed physically. This is critical when conducting business with SAT, such as updating your taxpayer status, submitting your annual tax return, or entering into government contracts.

- Mandatory for businesses and individuals with certain income levels: Although not all taxpayers are required to have an e.firma, it is mandatory for businesses and individuals earning above a certain income threshold to obtain one in order to comply with tax reporting requirements.

- Required for certain procedures: Many SAT processes, including registering or updating your RFC, are done electronically and require the e.firma. Additionally, it is essential for those who need to issue electronic invoices (CFDI – electronic version of a factura) or perform higher-level financial transactions.

Relationship between RFC and e.firma:

-

- RFC is primarily used to identify you as a taxpayer.

- e.firma verifies your identity when interacting digitally with SAT and other government services, ensuring that your tax filings and official documents are secure and legally valid.

In short, the e.firma is your secure digital key to interacting with SAT online, while the RFC is your taxpayer identification.

Situations Requiring a Temporary RFC

If you are not yet a resident of Mexico but need to engage in economic activities, such as buying property, you may be able to apply for a temporary RFC. This number allows you to complete specific transactions without becoming a full tax resident.

Renewing or Updating Your RFC

If your information changes (e.g., change of address, legal name, etc.), you’ll need to update your RFC with SAT. You can do this by visiting a local SAT office or using the online portal, which requires an e.firma. Failure to keep your RFC information current could result in fines or penalties.

Frequently Asked Questions

Q: Do tourists need an RFC?

A: Tourists typically do not need an RFC unless they plan to conduct business or purchase property in Mexico.

Q: Is the RFC mandatory for opening a bank account?

A: Yes, technically, banks require an RFC for both personal and business accounts from a legal perspective. Though some bank branches might allow you to open an account without one. However, that would be the exception rather than the rule.

Q: How long does it take to get an RFC?

A: Typically, the same day at the conclusion of your in-person appointment. Processing times may vary through the Virtual Office.

Q: Can I get an RFC without residency?

A: In most cases, you will need temporary or permanent residency to obtain an RFC, unless you are applying for a temporary RFC for a specific transaction like a property purchase.

Helpful Online Resources

Stay up-to-date on all the current requirements and processes, as outlined in this article, by visiting the following websites:

-

- SAT: Mexico’s official federal government agency responsible for the collection of taxes from individuals and businesses.

Conclusion

The RFC is an essential part of life in Mexico, whether you’re living here temporarily or permanently. From opening a bank account to filing taxes, this tax identification number is your key to participating in Mexico’s financial and legal systems. Understanding the RFC process and why it’s required can help you navigate these systems more smoothly, ensuring that you remain compliant with local regulations.

Please feel free to leave us a comment below about your personal experience of obtaining an RFC. We would love to hear from you! Additionally, if you found this article helpful, consider sharing it with others who might benefit from it. A quick share goes a long way in helping others discover useful information!

when was this article published? There’s no date and it seems like the SAT system is not allowing virtual appointments because I was sent a “token” but no where to input this code.

I wrote the article late last year. However, the virtual office option appears to be a new functionality from SAT. With the fairly new administration, a lot of the federal agencies, including SAT, are being overhauled along with any of their publicly facing websites, internal systems, etc. In years past, you were able to obtain your RFC online. However, as of the at least the last 3 or so years, it was in-person only. But it appears that they are trying to bring the online option back via their virtual office. However, there is a very decent chance that their virtual office system is not fully baked yet. My advice would be to schedule an appointment to physically go into your local SAT office. In the meantime, I will update the article to reflect this potential new pathway via SAT’s virtual office. Also, based on other feedback, I am also looking to add a review on/last updated date on all of my articles for further transparency.