Understanding the financial requirements for residency in Mexico is essential for a successful residency application. The requirements outlined in this article are the baseline financial thresholds as defined by the Secretaría de Relaciones Exteriores (SRE) for 2025, but it’s important to note that individual consulates may adjust these amounts. Some consulates have higher requirements than what are listed below and some might even be less. This completely depends on the exchange rate that the consulate used in making their calculations, which are based on multiples of Mexico’s daily minimum wage. So, it’s crucial to verify specific financial requirements with the consulate where you intend to apply. Also, please be aware that there are other pathways (e.g., family unity, scientific research, religious activities, etc.) to obtaining residency but proving financial solvency is the most common path for the overwhelming majority of people.

Additionally, consulates may differ in the types of financial accounts they accept (e.g., savings, taxable brokerage, 401(k), etc.) and how they require documentation to be presented (e.g., summary pages, full statements, or stamped/certified copies from the financial institution). Always confirm these details directly with the consulate you intend on using.

The amounts below are based on a 20:1 (MXN to USD) exchange rate (based on the approximate exchange rate at the end of 2024) and are subject to change at any time and are simply presented for illustration purposes. Like already stated, be sure to verify the exact amounts with the consulate you plan on using since their amounts can vary from what is illustrated below. These amounts can often be found on the respective consulate’s website.

Temporary Residency

Temporary residency suits individuals planning to live in Mexico for more than 6 months but less than 4 years. This option is ideal for retirees, digital nomads, or those considering a permanent move later. The below are the baseline financial requirements, as defined by SRE, for 2025. You can qualify by using ONLY one of the following methods, not a combination:

-

- Monthly savings:

- Maintain a monthly balance equivalent to 5,000 days of the daily minimum wage ($278.80 MXN) for the past 12 months.

- Calculation: 5,000 × $278.80 = $1,394,000 MXN (~$69,700 USD) average monthly balance.

- Monthly net Income:

- Earn a monthly net income equivalent to 300 days of the daily minimum wage ($278.80 MXN) for the past 6 months.

- Calculation: 300 × $278.80 = $83,640 MXN (~$4,180 USD) monthly income.

- Property ownership:

- Own property in Mexico valued at 40,000 days of the daily minimum wage ($278.80 MXN). There might also be additional requirements such as free of liens, needs to be your primary residence, certain amount of equity, not held in a fideicomiso (bank trust), etc.

- Calculation: 40,000 × $278.80 = $11,152,000 MXN (~$557,600 USD).

- Monthly savings:

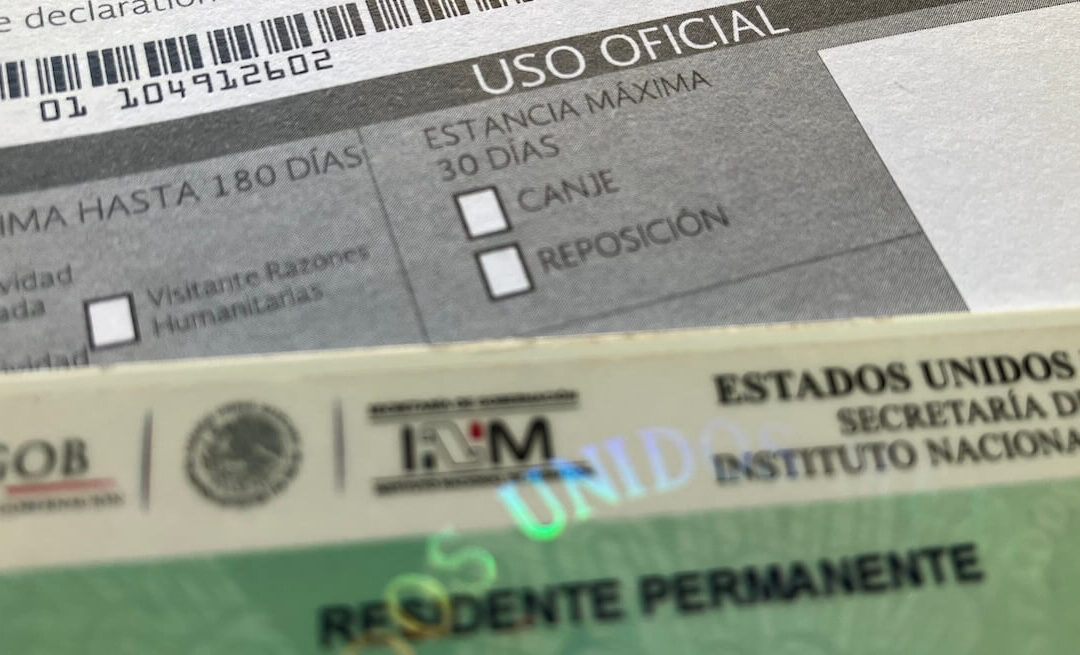

Permanent Residency

Permanent residency is for individuals planning to live in Mexico indefinitely. This is particularly suitable for retirees or those with long-term financial stability. The below are the baseline financial requirements, as defined by SRE, for 2025. You can qualify by using ONLY one of the following methods, not a combination:

-

- Monthly savings:

- Maintain a monthly balance equivalent to 20,000 days of the daily minimum wage ($278.80 MXN) for the past 12 months.

- Calculation: 20,000 × $278.80 = $5,576,600 MXN (~$278,800 USD) average monthly balance.

- Monthly net income:

- Earn a monthly net income equivalent to 500 days of the daily minimum wage ($278.80 MXN) for the past 6 months.

- Calculation: 500 × $278.80 = $139,400 MXN (~$6,970 USD) monthly income.

- Monthly savings:

Key Considerations

Monthly savings or monthly net income:

-

- Applicants typically qualify using either their savings or net income, not a combination of both methods.

Individual vs. dependent applications:

-

- Per individual: Financial requirements are generally per individual unless the consulate permits a primary applicant as the sponsoring individual with dependents (e.g., married couples, families, common law spouses/partners, etc.).

- Dependent thresholds: If allowed, dependents typically have much lower financial requirements than the sponsoring individual. However, if not permitted, applicants (e.g., married couples) must meet the financial thresholds as individuals and independent of each other.

Joint accounts:

-

- Be aware that some consulates may only count 50%, as an example, of joint account balances toward the financial qualification calculations of an applicant. Each consulate is different not only in their financial requirements but also in the calculations they use in qualifying applicants.

Consular variations:

-

- Permanent residency: Please note that many consulates will not consider applicants for permanent residency unless they are of the minimum retirement age as defined by the federal government in their home country As an example, this is typically 60 or 62 for individuals from Canada and the U.S., respectively. In addition, applicants need to be actively collecting government retirement benefits such as a pension or social security or meet the savings requirements. In some cases, consulates may prefer government retirement benefits over private pensions or other income sources. If you are not receiving any government retirement benefits, you might need to provide a formal letter from your previous employer verifying your retirement status. Additionally, applicants who are not of legal retirement age and are not collecting government retirement benefits may be required to demonstrate significantly higher savings or investment/pension income to be considered. Even then, approval is not guaranteed, as consulate discretion plays a significant role.

- Adjustments to amounts: Individual consulates may apply higher or lower thresholds than the baseline requirements defined by SRE. Often times, the amounts are higher than the baseline formulas.

- Accepted accounts: Verify which financial accounts (e.g., savings, taxable brokerage, 401(k)) are acceptable.

- Documentation requirements: Confirm whether the consulate requires summary pages, full statements, or certified/stamped copies from the bank or financial institution.

- Annual adjustments: The daily minimum wage ($278.80 MXN for 2025) is updated annually, so ensure you use the most recent figures for calculations.

This overview covers the financial thresholds for residency in Mexico. For additional details on the full application process, required documents, and consular-specific nuances, visit our in-depth articles:

Always check directly with your chosen consulate to confirm the most accurate and up-to-date information for your application. Here is a complete list of Mexican consulates.

Helpful Online Resources

Stay up-to-date on all relevant information in regards to Instituto Nacional de Migración (INM) as it relates to immigration matters, as outlined in this article, by checking the following websites:

-

- Gob.mx: Mexico’s official federal government portal with details on all government matters, including providing detailed information on immigration and more.

- INM: Mexico’s official federal government agency responsible for all matters related to immigration.

- INM micro website: Official website of INM where you can complete all immigration procedures/processes (trámites), schedule an appointment and more.

Conclusion

Understanding the financial requirements for temporary and permanent residency in Mexico is a critical first step in the application process. These baseline financial thresholds, as defined by SRE, for 2025 may vary depending on the consulate, so verifying specifics with your chosen consulate is essential. Be sure to confirm not only the exact amounts but also the accepted account types and documentation formats to streamline your application. Whether you qualify through savings or income, meeting these requirements will help you secure legal residency and start your new life in Mexico with confidence.

Please feel free to leave us a comment below about your personal experience of obtaining residency. We would love to hear from you! Additionally, if you found this article helpful, consider sharing it with others who might benefit from it. A quick share goes a long way in helping others discover useful information!

0 Comments